- Home EN

- News

- Latest news

- 2019

- Hotel Fund’s ESG strategy

Hotel Fund’s ESG strategy

Environmental, social and governance factors play a major role in our investment strategy. Our long-term goal is to have a net zero carbon, nearly energy neutral and climate resilient portfolio before 2045. This includes an analysis of asset-level climate risks and a plan on how to mitigate these risks, including a plan of how to mitigate these risks. We have set out clear targets for the reduction of our environmental footprint and improving our positive social impact. The basic premise of our ambition to become near energy neutral is that any improvements are affordable, fit into our existing maintenance cycle and are aligned with the area-focused approach of the municipal authorities in question.

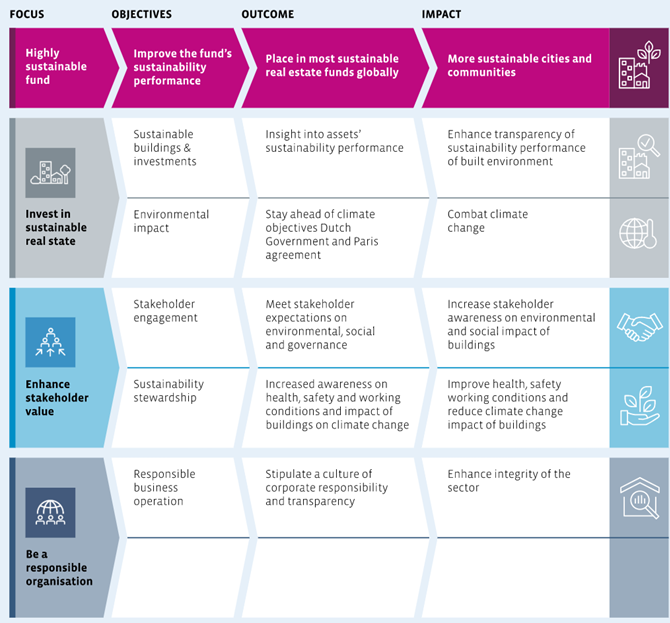

Our long-term strategy to keep the fund highly sustainable (GRESB 4/5-star rating) is based on three main pillars: invest in sustainable real estate, enhance stakeholder value and be a responsible organisation.

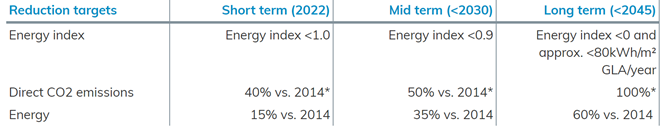

To achieve our long-term of ambition of having a net zero carbon, near energy neutral and climate resilient portfolio by 2045, the Fund has formulated the following environmental reduction targets for the short, mid and long term.